A Proprietary Program designed by APOLLO RISK MANAGEMENT

Financial Risk Management Program

DON'T LET THE MARKET, LEGAL MATTERS or TAXES, CRUSH YOUR RETIREMENT DREAMS

PROTECT & PROSPER FINANCIAL RISK MANAGEMENT PORTAL

The Apollo Risk Management System is an aggregation of software applications designed to be a personal CFO level operating system for financial analysis, professional guidance and wealth management. It is administered by a team of professionally licensed Fiduciary Advisors.

The focus is to help clients avoid unnecessary financial losses by building strategies of success through a combination of sophisticated technology, network intelligence, contractual guarantees and professional guidance.

Key Areas of

Risk Management Analysis

> Investment Risk Analysis

> Income, Expense and Cash Flow Analysis

> Debt Risk Analysis

> Taxation - Projections & Mitigation Analysis

> Business Succession & Equity Risk Analysis

> Litigation Exposure Analysis

> Legacy Transfer Costs & Tax Loss Analysis

VIP RISK MANAGEMENT Plan Pricing - $995 annually

A Comprehensive Financial Risk Analysis and Professional Wealth Management Operating System

*Apollo Protect & Prosper - Members ONLY Education Portal - $597 annually

Protect and Prosper - Financial Risk Management Modules

*On-Point Portfolio Risk Analysis & Reporting - $297 one-time

Your transactions are 100% secured.

We use the best possible encryption method available.

Our Partners...

Before Risk Management Financial Stress Is a Nightmare

Fear that the stock market will crush you financially

Fear that your retirement savings won't be enough

Fear that taxes and inflation will erode your wealth

Fear a potential lawsuit will devastate your business

Fear that you will never be able to retire comfortably

The Apollo Risk Management System is an aggregation of some of the most powerful software applications and intelligence algorithms available today, sequenced in such a way as to provide unparalleled financial risk management. Available to anyone, working at any company, regardless of where they are invested.

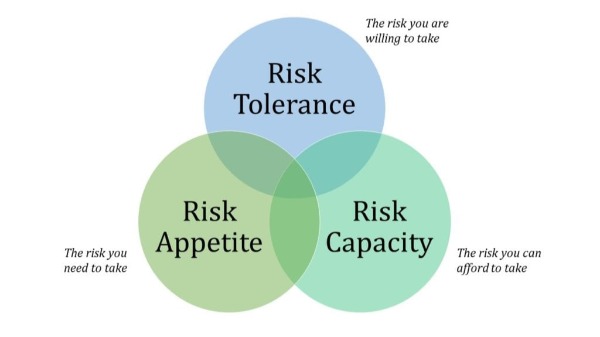

Step 1: The Risk Analyzer

The Risk Analyzer quantifies "Personal Risk Capacity", Analyzes that "Risk Exposure" within an existing portfolio, then makes allocation recommendations on how to reduce risk by 30%-50% without compromising return potential.

Step 2: Risk Allocation Optimization

The optimization of risk allocation is the most overlooked process in financial planning. It sets a baseline so investors know exactly how much of their funds are protected from market losses, and precisely what will be available to them when they retire as a guaranteed pension payout, should they choose that option. This step allows us to control losses as a defined strategy.

Step3: Retirement Analyzer

The third step is the Retirement Analyzer for our VIP clients. One of the most powerful analytical planning tools on the market, it provides a deep visual look at where you are financially today and where you can expect to be tomorrow. It answers the questions.....

- Can I afford to retire?

- Will I have enough income throughout retirement?

- What effect will taxes have on cash flow?

- Am I prepared for inflation or a stock market crash?

- Which assets are subject to probate?

- If I'm sued , what's at risk?

- And much, much more...

VIP RISK MANAGEMENT Plan Pricing - $995 annually

A Comprehensive Financial Risk Analysis and Professional Wealth Management Operating System

*Apollo Protect & Prosper - Members ONLY Education Portal - $597 annually

Protect and Prosper with Financial Risk Management Modules

*On-Point Portfolio Risk Analysis and Reporting- $297 one-time

Your transactions are 100% secured. We use the best possible encryption method available.

After Risk Management

What Stress?

You're fully confident with your investments.

You have a clear picture of your projected retirement cash flows.

You are comfortable knowing your assets are insulated from potential lawsuits

You have CPA approved strategies designed by the Apollo Advisor team to help you meet your goals.

You are looking forward to an amazing retirement.

Here are the 3 CORE PRINCIPLES on which the Apollo Risk Management System was built:

Clarity of "Risk Exposure & Risk Capacity"

Once you plug into the Apollo system, you will have a very clear picture of your risk exposure and how your current investment portfolio measures up against your desired risk capacity .

-

You will be able to see if you are taking on too much risk or too little risk to achieve your goals.

-

You will be instructed on how to better allocate your assets and investments to achieve your financial goals.

-

You will have more confidence and peace of mind that the investments you have are right for you.

Clarity in Navigating Risky Markets

Protect & Prosper Membership

$597 annual

Using the Protect and Prosper educational modules clients can learn how to better manage financial risk through a better understanding of all disciplines, investment risk, debt risk, family/legacy risk, tax risk and wealth management risk. We then provide the tools and expertise to take action to mitigate those risks.

-

Learn how to better allocate resourses based on targeted goals.

-

Learn how to effectively avoid and eliminate bad debt and better manage future capital needs.

-

Learn how to protect your family from the financial nightmare that happens when someone dies.

Learn how to reduce taxation on income, investment gains, on asset sales, on real estate holdings, on distributing from qualified retirement accounts.

Clarity with Your Financial Goals

Our Retirement Analyzer software for VIP clients provides laser clarity on your personal financial picture. It provides a visual of where you are today and projection of where you can expect to be in the future.

-

Know how much income you'll need and have at retirement.

-

Know when is financially the best time to retire.

-

Know your family will be all right if something happens to you.

-

Know how best to mitigate taxes before and during retirement.

-

Know you have a plan to avoid losses and never run out of money.

Here's More Details On What You Get When You Enroll In The Apollo Risk Management System !

One-on-One Discovery Call with a Professional Fiduciary Advisor

The system is powered by Professional Fiduciaries trained to provide individualized service in helping our clients meet their goals. We want to know who you are, and we want you to know who we are, both professionally and personally.

Personal Risk Exposure Analysis

Every investor's financial situation is unique regardless of their intended retirement date. Therefore, every person's "Risk Exposure" is also unique and must be quantified and in line with their personal objectives and risk capacity.

Annual and Lifetime Tax Loss Analysis (VIP)

The systems powerful software provides indepth tax projections on a monthly, annual and lifetime bases. This data allows us to identify tax mitigation opportunities when generating income, selling appreciated assets or distributing wealth.

Inflation Exposure to Income & Expense Analysis (VIP)

A deep look into the ability of income and cashflows to cover inflation adjusted expenses throughout retirement. Will you run out of money or be forced to compromise quality of life?

Legacy Loss Analysis

What is the "financial loss exposure" in the event of death? Will the family's quality of life be at risk? Will there be excessive tax losses? Will there be able cash flow and liquid assets? How much will probate errode from the estate? Will my legacy be that of a nightmare process for my family?

Litigation Exposure Analysis (VIP)

What is the "financial loss exposure" in the event of a lawsuit? What assets could be at risk of siesure or forced liquidation? What assets are protected from judgements? What activities, business or personal, have me exposed to liability? Do I have the right insurance in place?

Risk Mitigation Options Report (VIP)

Simple, precise, actionable options, supported by data, that acts as a guild in minimizing and or eliminating financial risk, asset by asset. Puts the client in the drivers seat on accepting the risk, transfering the risk, reducing it or eliminating the risks.

Personalized Allocation Recommendations

Every investor, regardless of the company they work for or the plan they are invested in, is provided a personalized allocation recommendation based on their "risk capacity" and the funds available to them within their plan.

Income Gap and Income Cliff Solution Planning

This planning seeks to eliminate the "Income Gap" frequently seen between required retirement cash flow and current guaranteed income. "Income Cliff' is experienced by many widows when their spouse dies. Private Pension Planning solves both.

401k Asset Protection

Our team helps build plans to protect hard earned 401k savings. Private pension planning allocates to risk off assets ensuring that portfolios remains inline with "Risk Capacity" and future income requirements are guaranteed not to be lost to volatile markets.

Financial Analyzer Software (VIP)

Can you afford to retire? The Retirement Analyzer Software provides visual clarity to where you are and where you can expect to be financially before and during retirement. A deep look at future cash flows, expenses, taxes, inflation, legacy funds, expected and unexpected financial situations- everything organized in one place.

One-on-One Private Strategy Sessions (VIP)

Every year we will revisit the financial plan during our one-on-one strategy sessions. Together we will review the plan, tweak the plan, look for options that improve on the outcome and strategize toward new or changing financial goals. Its your call, it's your opportunity to tap our expertise.

Full Colaboration with Your CPA

The system was designed to be a collaborative tool for CPAs to utilize in helping clients make educated financial decisions and encorporate long term tax mitigation strategies. It provides CPAs access to a whole nother level of data analytics and expertice to help their clients.

Access to Private Money Management

Those who prefer not to manage their investments, can access vetted private money managers to do it for them, within a personal brokerage account or right within their company retirement plan.

LIFETIME PROFESSIONAL SUPPORT

The Apollo Risk Management System was designed to protect you against devastating financial loses for life. As long as you are a client, you will be supported by a Professional Fiduciary Advisor working directly with your CPA to put your best interest at heart. Together your goals will always be our mission.

A Private Secure Data Vault (VIP)

Our system includes a private cloud based data vault in which to organize all important documents such as Wills, Trusts, POAs, Heath Care Directives, Insurance Policies, Operating Agreements, Real Estate Deeds, and account statements. Providing ease of access for you, your trusted family members, attorneys, or executors in the event original documents are lost or destroyed.

Take Advantage of this Risk Management System at Amazingly Affordable Pricing

VIP Plan Pricing - $995 annually

A Comprehensive Financial Analysis and Professional Wealth Management Operating System

*Apollo Protect & Prosper - Members ONLY Education Portal - $597 annually

Protect and Prosper with Financial Risk Edu Modules

*On-Point Portfolio Risk Analysis & Reporting - $297 one-time

Your transactions are 100% secured. We use the best possible encryption method available.

Questions Regarding the

Apollo Risk Management System Answered

Is the Apollo Risk Management System and other Software complicated to use?

The Apollo System is set up for you by a Professional Fiduciary Advisors. There is no software to download or learn how to use. You provide us the financial data and funds available in your portfolios, and we do all the work. Our team does the risk assessments and provides a recommended allocation based on available funds and your personal risk profile. You allocate within your retirement account as directed, our team monitors those funds daily and directs you on when to buy, sell and rebalance as determined by market conditions. If you prefer not to manage the account yourself, it can be done for you.

What is the difference between the EDUCATION subscription and the VIP subscription?

The Apollo Protect & Prosper EDU Membership is a forum covering the "Pillars of Financial Risk Management". Investment, Debt, Legal, Tax, Legacy and Wealth Management. Members are provided the tools to conduct personal risk capacity & exposure analysis, along with 1 on 1 professional software analysis and allocation recommendations. Protect & Prosper Portal Membership $397yr.

The Apollo VIP plan is a comprehensive financial and estate planning operating system designed for analysis and wealth management. VIP clients receive a deep dive analysis of assets, liabilities, cash flow to expenses, in-force insurance review, current and future tax analysis and mitigation recommendations, estate documents analysis, inflation and life longevity stress testing, as well as a cloud-based data vault to safely hold all important documents. VIP clients receive annual strategy sessions to focus on how best to enhance their financial outcomes. Reports are shared and tax related recommendations are collaborated with your CPA.

Do I have to move my money?

Sometimes. The Apollo system works for any client, in any corporate retirement 401k, 403b or 457 plan. We simply guide you on better managing those investments with a focus on protecting against devastating losses. Should you choose to put in place a Private Pension Plan or build an In-Direct Indexed Portfolio funds would need to be redirected to the financial institution providing those contracts.

Will an Apollo Advisor have access to my retirement account?

Typically no. We will not have, nor do we need access to your 401K, 403b or 457 account. You will always remain in control of your corporate retirement account. Should you choose to work with our affiliated money managers, we will establish an account on your behalf at Charles Schwab. You will authorize the private money manager to monitor the market and execute the transactions for you within your CS account. Your Apollo Fiduciary Advisor will assist in establishing the account, building the optimum portfolio allocation, monitoring managers and strategy progress, and fund transfers at your directive in or out of the account.

What kind of support can I expect?

The Apollo system is administered by Fiduciary Advisors. Our advisors are required by law to act in the best interest of the client and ensure no conflicts of interest exist. Advisors are always accessible by phone, email, or text, with every client having calendar access to schedule a meeting at their convenience.

What if I leave my job, CPA or need to cancel my subscription?

The Apollo system was designed to be a companion protection tool for life. Like auto insurance is to driving. Our system is portable and can be utilized regardless of where your retirement investments are or who your CPA is. If you change CPAs or leave your job our professional advisors will assist you in staying the course by maintaining oversite and protection in place. However, we understand life happens and we do not believe in lengthy contracts or forcing clients to work with us. Subscribers may opt out, with notice, 15 days prior to their enrollment anniversary.

Apollo Risk Management a division of Apollo Advisory Inc. All Rights Reserved

Investment related advisor services are provided through ADVISOR SHARES WEALTH MANAGEMENT, LLC a SEC Registered Investment Advisory Firm. ASWM and Apollo Risk Management operate independently. Conducting business only in States they are properly registered. Registration is not an endorsement by regulators. Investments are not guaranteed and may lose value.